The stock has maintained support base near Rs 155 zone where on thrice occasion it has recovered from those levels and indicated a pullback.Ĭurrently the stock moving above the 200-DMA (days moving average) and 50-day EMA (exponential moving average) levels of Rs 164 and Rs 167 levels respectively has shown strength in this weak market and is anticipated to carry on the momentum further till Rs 178 levels for the near term perspective.

Here's what Vaishali Parekh of Prabhudas Lilladher recommends investors should do with these stocks when the market resumes trading today: It has been making higher highs higher lows formation for second consecutive session. The stock closed with 1.7 percent gains at Rs 116.4, with above average volumes. NMDC has also formed bullish candle with long upper shadow on the daily scale, indicating a bit of profit booking at higher levels. The stock traded with above average volumes while taking support at Rs 355 levels. Mahindra CIE Automotive was also in focus, rising 3 percent to Rs 371 and formed bullish candle on the daily charts with long upper and lower shadows indicating a bit of volatility in the counter.

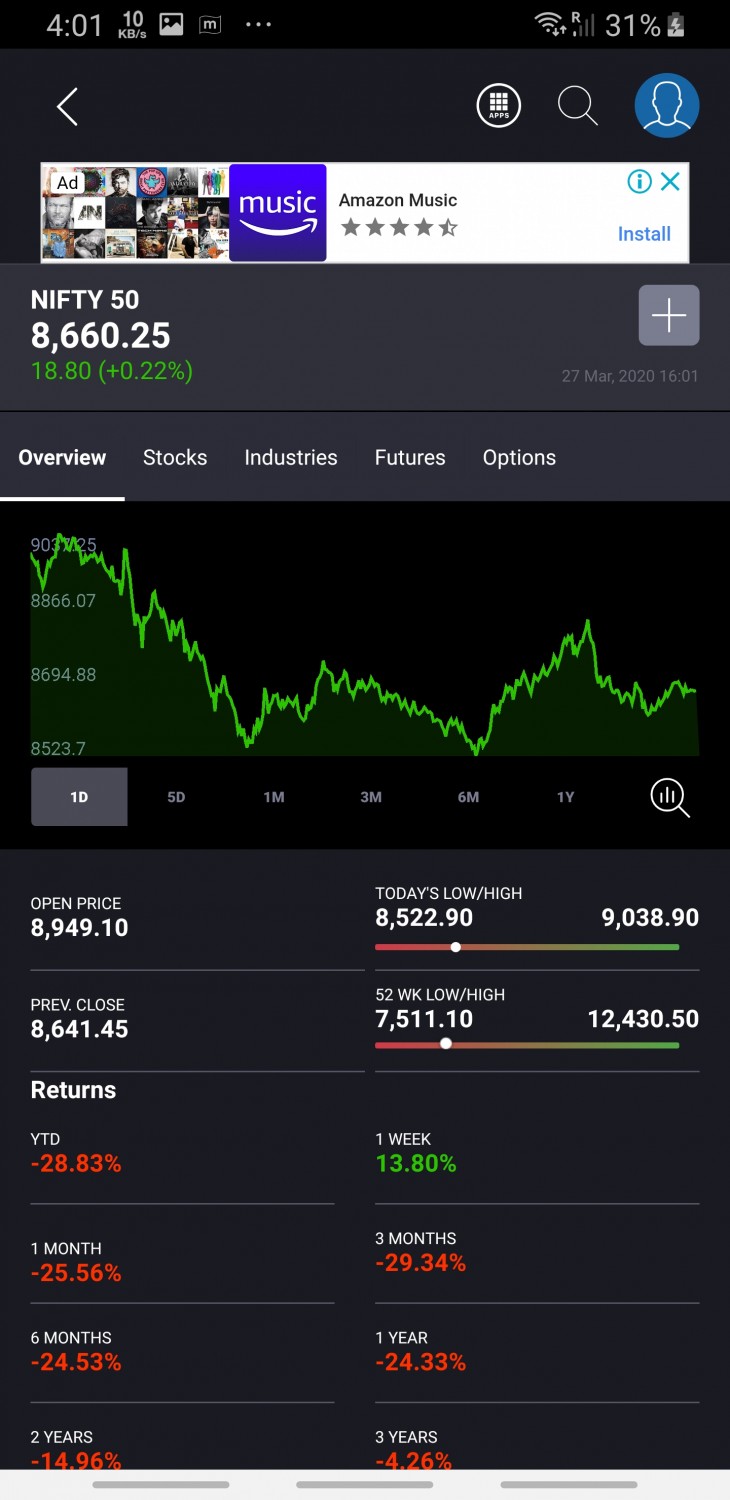

The stock got back above 200 DMA as well as 200 EMA with Tuesday's rally. Stocks that performed better than broader markets included EIH, which climbed 4 percent to Rs 168.4 and formed a bullish engulfing pattern on the daily charts with above-average volumes, indicating the possibility of further upside in coming sessions. The broader markets also traded lower with the Nifty Midcap 100 and Smallcap 100 indices falling half a percent and eight-tenth of a percent, respectively. The BSE Sensex fell more than 300 points to 57,900, while the Nifty50 declined more than 100 points to 17,043, the lowest closing level since October 13, and formed a bearish candle on the daily charts. The market has fallen 4 percent in the last four sessions and hit a fresh five-month closing low on March 14, but experts feel it seems to be looking oversold with momentum indicator RSI (relative strength index) at 32 levels and the Nifty and RSI structure on daily charts seem to be showing a bullish divergence, indicating the possibility of a rebound.

0 kommentar(er)

0 kommentar(er)